Gulf Energy News

2025 Gas Market Review Submission

On 30 June 2025 the Commonwealth Government of Australia announced that the Department of Industry, Science and Resources and the Department of Climate Change, Energy, the Environment and Water would jointly conduct a Gas Market Review to examine the key instruments for securing domestic gas supply.

Gulf Energy Pty Limited (Gulf Energy) is pleased to advise that it has lodged a submission to the Australian Government entitled National Gas Sovereignty Framework – A Strategic Policy Response to Australia's Energy Security Crisis.

Gulf Energy’s submission proposes a legislative, regulatory, and fiscal framework to secure Australia’s domestic gas supply, stabilise prices, and preserve export reliability, while establishing a sovereign wealth mechanism for intergenerational benefit. The key measures include:

Enactment of a National Gas Sovereignty Act with a 10-year mandate and Commonwealth supremacy where national security is at stake.

Dynamic domestic reservation of a minimum 15% for new projects (post-2027 FID), rising to 25% in periods of shortfall, with existing export contracts grandfathered.

Domestic pricing safeguards to ensure fair-value benchmarks and break the direct LNG netback link for domestic users.

Development of strategic storage equivalent to three months’ national demand, with ring-fenced reserves for Defence and critical infrastructure.

Introduction of a Frontier Exploration Incentive Scheme providing a 150% tax deduction for qualifying junior exploration with domestic supply commitments.

Creation of a Sovereign Energy Transition Fund allocating 5–15% of gas royalties/taxes for intergenerational benefit, modelled on Norway’s Government Pension Fund Global.

The recommendations are based on analysis of projected east coast supply shortfalls from 2025 onwards, the scale of the $7–9 trillion Net Zero transition investment requirement, and international precedents demonstrating the consequences of inadequate domestic gas security.

To read Gulf Energy’s submission please Click Here

Background to the Gas Market Review

In announcing the Gas Market Review, the Australian Government said:

“The review will examine the:

Australian Domestic Gas Security Mechanism (AGDSM)

Gas Market Code (the Code)

Heads of Agreement (HoA) with east coast liquified natural gas (LNG) exporters.

It will look at whether we can improve and streamline these instruments to ensure sufficient affordable gas supply in the longer term. This will help deliver on the Future Gas Strategy, which spells out the role gas will play alongside renewables, batteries and pumped hydro in securing Australia’s energy future.

A combined review ensures that we consider gas market regulation effectively and efficiently. This will help improve outcomes for market participants and minimise regulatory burden.

We’ll consider:

the effectiveness of current policies and regulations

whether the regulatory interventions remain suitable

opportunities for streamlining and consolidating the regulatory approach

alternative approaches to addressing current challenges.

We are seeking feedback from industry, stakeholders and anyone with an interest in the gas market.

We will provide a review report to the Minister for Climate Change and Energy and the Minister for Resources. The government will consider recommendations from the review and next steps. The current regulations will remain in place until we finalise the review and make changes. We’ll likely consult further on the details of any significant changes.”

Further details about the Gas Market Review can be found here.

Gulf Energy Signs LOI For TS Jasper Jackup MODU

Gulf Energy Pty Limited (Gulf Energy) is pleased to announce that it has signed a non-binding Letter of Intent (LOI) with Titan Drilling LLC (Titan) of the USA for the services of the TS Jasper jackup MODU. Gulf Energy’s intention is to use the TS Jasper to drill its Lion Prospect, which has been independently assessed to have the potential to hold as much as 10 Tcf of estimated recoverable gas resources. It is currently intended to drill the Lion-1 exploration well in mid-2026, subject to several factors including receiving all necessary regulatory approvals.

Titan is a wholly owned subsidiary of Greenbond Group, registered in Delaware USA, with its HQ in Houston Texas. Greenbond is in the process of funding the purchase of the TS Jasper and plans to use it to develop a series of small fields of the NW Coast of Australia. The rig is currently in Singapore and is anticipated to be delivered by the end of 2025. It will be offered to the Australian market for approximately one year before deploying to the NW Coast to work as a MODPU. The TS Jasper is a KFELS N+ type and is one of the largest designs of jackup drilling rig available.

The LOI between Gulf Energy and Titan describes a number of conditions and milestones to be achieved including negotiating a drilling contract, which will begin shortly.

The signing of the LOI coincides with the recent policy announcement by the Commonwealth Government of its Future Gas Strategy is very encouraging and recognises that new sources of gas supply are needed to meet demand during the economy-wide transition.

In releasing the policy, Resources Minister Madeleine King said:

“Gas plays a crucial role in supporting our economy, with the sector employing 20,000 people across the country, including remote and regional communities.”

“Ensuring Australia continues to have adequate access to reasonably priced gas will be key to delivering an 82 per cent renewable energy grid by 2030, and to achieve our commitment to net zero emissions by 2050.

“The Strategy makes it clear that gas will remain an important source of energy through to 2050 and beyond, and its uses will change as we improve industrial energy efficiency, firm renewables, and reduce emissions.

“But it is clear we will need continued exploration, investment and development in the sector to support the path to net zero for Australia and for our export partners, and to avoid a shortfall in gas supplies.”

The most recent forecasts by the Australian Competition & Consumer Commission (ACCC) and the Australian Energy Market Operator (AEMO) have forecast gas supply shortfalls in meeting predicted east coast Australian demand in the next few years. AEMO also predicts that early next decade there will be insufficient gas available in eastern Australia to supply LNG export contracts that Australia has with its Asian partners.

New sources of gas will be need and the Bamaga Basin, with an independently assessed high side potential to hold more than 35 Tcf of estimated recoverable gas resources, could be a major contributor to meeting Australia’s gas shortfall challenge.

S&P Global Recognises Lion-1 as a High Impact Well

Leading international firm Global Commodity Insights (S&P) has recognised Lion-1, Gulf Energy’s proposed first exploration well in the Bamaga basin, as a High Impact Well (HIW). S&P provides high quality research and insights and essential intelligence about the oil and gas industry.

Leading international firm Global Commodity Insights (S&P) has recognised Lion-1, Gulf Energy’s proposed first exploration well in the Bamaga basin, as a High Impact Well (HIW). S&P provides high quality research and insights and essential intelligence about the oil and gas industry.

In a S&P December 2022 article entitled “2022 exploration drilling review and 2023 High Impact well (HIW) drilling outlook”, written by Jack Rivers and Stuart Lewis, list the 2022 exploration wells that found the most oil and gas and their impact on the overall global petroleum reserves situation.

They also pinpoint HIW for 2023 and on their list is Lion-1, the first Gulf Energy exploration well planned for its Q/23P project in the Gulf of Carpentaria, Queensland.

The Lion Prospect is a four-way dip closure covering 245 square kilometres, with the potential to hold 3.8 Tcf of natural gas recoverable resources (Base Case), and possibly as much as 10.3 Tcf.

S&P indicate Lion-1 will be drilled this year but it is more likely to be drilled in 2024.

You can read the full S&P Global article here.

Gulf Energy Meets with Queensland Minister for Resources, Hon. Scott Stewart MP

Minister for Resources in Queensland, the Honourable Scott Stewart MP recently invited Gulf Energy Pty Limited’s (GULF) managing director to meet with him, to discuss GULF’s Q/23P project.

Minister for Resources in Queensland, the Honourable Scott Stewart MP recently invited Gulf Energy Pty Limited’s (GULF) managing director to meet with him, to discuss GULF’s Q/23P project.

The Minister and his team were briefed on the project and the results of technical analyses conducted earlier this year which have considerably enhanced the Bamaga Basin’s prospectivity. The following information shared with the Minister was highlighted:

An independent, ‘grass roots’ technical study has established that the most likely age of rocks in the Bamaga Basin target zone are the same as in the Perth Basin and Bedout Sub-basin, where commercial hydrocarbons have been discovered.

Analysis by Schlumberger on drilling cuttings from the Duyken-1 well, not far from Q/23P, has found inclusions of mature gas (with associated hydrocarbon liquids). The only place these hydrocarbons could have come from is the Bamaga Basin. This has markedly increased the Probability of Success for a petroleum discovery at Q/23P’s Lion Prospect.

Based on the above, the potential gas volumes one could expect to find at Lion and in Q/23P have significantly increased.

The Minister recognised the Q/23P project’s gas potential and showed support for GULF’s groundbreaking exploration. He acknowledged that a commercial gas discovery at Q/23P could substantially benefit energy consumers in Queensland and eastern Australia.

Q/23P Could Hold 30+Tcf of Recoverable Gas Resources

As recently announced, Gulf Energy Pty Limited (Gulf Energy) has undertaken three studies which have yielded very important results:

Bamaga Basin Analogues Study - concluded that the Bamaga Basin (Q23/P) characteristics could be analogous to the Bowen, Perth and Bedout basins, all of which have significant oil and gas discoveries.

Duyken-1 Fluid Inclusions Stratigraphic Analysis - demonstrates that the Bamaga Basin has generated, and is still generating, gas with associated gas liquids.

Seismic Inversion Analysis Over Lion Prospect – seismic inversion analyses show that average P-Impedance drops over the crest of the Lion Prospect approximately coincident with the spill point. A drop in P-Impedance could indicate presence of hydrocarbon and porosity over the crest of the Lion Prospect.

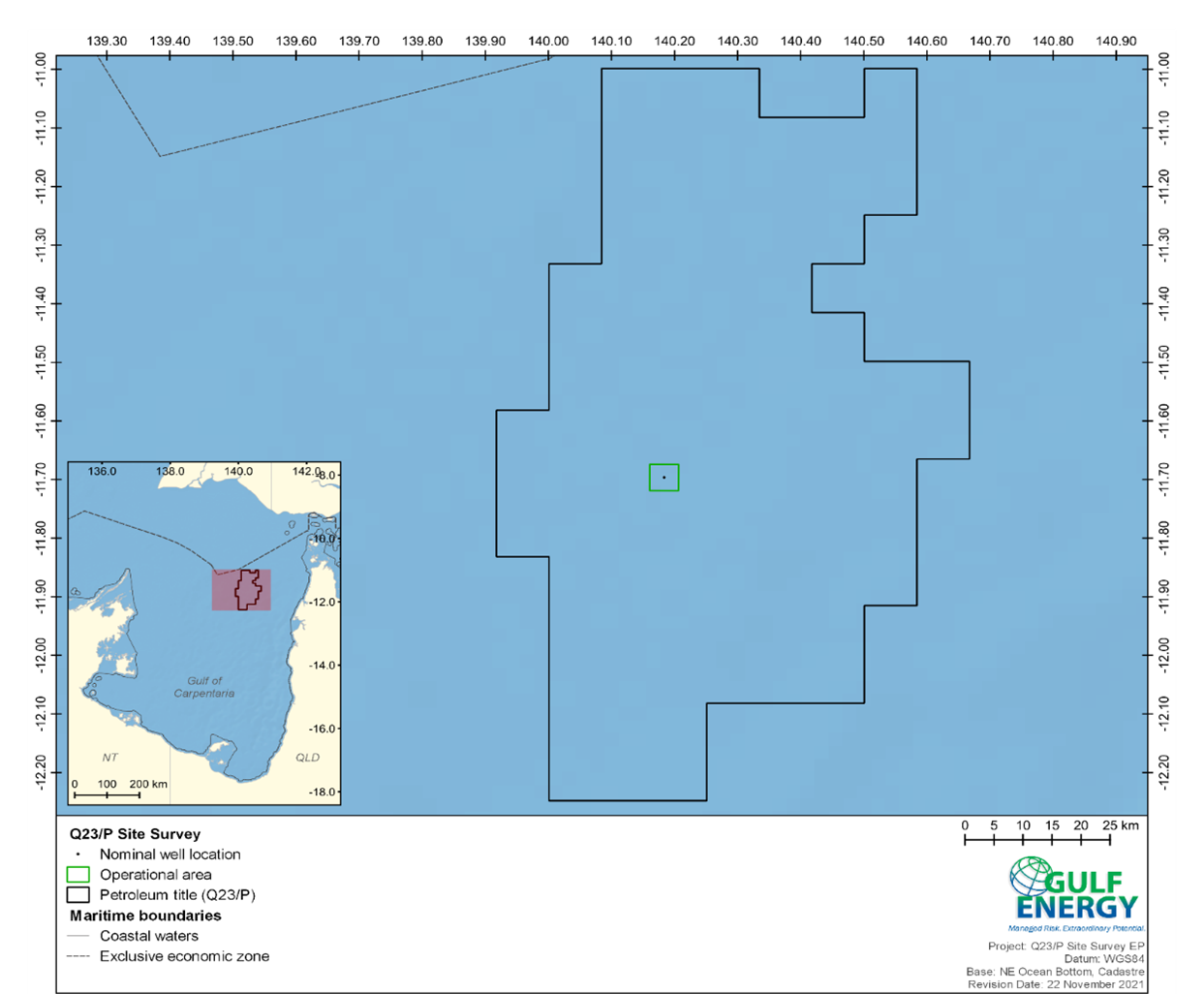

Based on these results, an independent reassessment was undertaken by Molyneaux Advisors of the potential recoverable gas resources of the prospect and leads so far identified in Q/23P (refer to the map below).

The reassessment concluded that:

The Lion Prospect could contain 3.8 Tcf of potential recoverable gas resources (Base Case) and possibly as much as 10.3 Tcf (High Case), and

Total potential recoverable gas resources in Q/23P could be 13.2 Tcf (Base Case) and possibly more than 30 Tcf (High Case)* .

* Arithmetic summation

Seismic Data Inversion Analysis Increases Potential of Lion Prospect

Gulf Energy Pty Limited (Gulf Energy) recently commissioned a leading expert in seismic data inversion to analyse the data from two key seismic lines across the Lion Prospect in the Bamaga Basin. Lion is the first prospect Gulf Energy proposes to drill in Q/23P.

Gulf Energy Pty Limited (Gulf Energy) recently commissioned a leading expert in seismic data inversion to analyse the data from two key seismic lines across the Lion Prospect in the Bamaga Basin. Lion is the first prospect Gulf Energy proposes to drill in Q/23P.

Seismic data inversion can indicate the properties of the rock the reflected seismic signal travels through and, if the rock is porous, the nature of the fluids in the rock. The analysis of the seismic data inversion on two cross lines over the crest of Lion Prospect show a marked decrease in P-Impedance with the edges of the P-Impedance ‘low’ approximately coincident with the mapped spill point of the Lion Prospect closure (refer to figure below). Based on industry experience, a P-Impedance decrease could be indicative of porous reservoir rock containing hydrocarbons (gas and/or petroleum liquids). This is very positive for Lion’s prospectivity.

How Does Seismic Data Inversion Help Petroleum Exploration?

Seismic inversion is essentially a very simple procedure. In a seismic inversion the original reflectivity data, as typically recorded routinely, is converted from an interface property (i.e., a reflection) to a rock property known as impedance, which itself is the multiplication of sonic velocity and bulk density. In a conventional seismic reflectivity section, the strong amplitudes are associated with the boundaries between geological formations, such as the top reservoir. This type of data is most suited to structural interpretation. In an inverted dataset the amplitudes are now describing the internal rock properties, such as lithology type, porosity or the fluid type in the rocks (brine or hydrocarbons). Inverted data is ideal for stratigraphic interpretation and reservoir characterization.

Gulf Energy Applies for Further Suspension and Extension of Q/23P

Gulf Energy Pty Limited (Gulf Energy) has applied to the National Offshore Petroleum Titles Administrator (NOPTA) for a further suspension and extension of the period in which to fulfill the current permit work obligations, namely the drilling of an exploration well. The Q/23P permit obligations currently require an exploration well to be drilled in Q/23P by 17 August 2022.

Gulf Energy Pty Limited (Gulf Energy) has applied to the National Offshore Petroleum Titles Administrator (NOPTA) for a further suspension and extension of the period in which to fulfill the current permit work obligations, namely the drilling of an exploration well. The Q/23P permit obligations currently require an exploration well to be drilled in Q/23P by 17 August 2022.

Gulf Energy was obliged to take this step because of difficulties with securing a suitable jackup drilling rig to drill the exploration well (Lion-1). The Company has retained the services of Perth-based Aztech Well Construction (Aztech) to design and manage the drilling of the well. Aztech has informed us that there are only two offshore jackup drilling rigs in Australia, and their owners have indicated that, in the near term they are not able to commit to a contract to drill the exploration well for Gulf Energy. Aztech searched overseas for suitable jackup drilling rigs, but none were available on satisfactory terms or within an acceptable time frame.

Factors Influencing Timing

The timing of the drilling of Gulf Energy is constrained by two important factors:

The Prawn fishing seasons

Prawn fishing takes place in the Gulf of Carpentaria from April to mid-June and from August to November each year. While Q/23P is well out to sea and away from the prawn traditional fishing areas, Gulf Energy, being prudent and conscientious, does not want to conduct offshore operations such as drilling during the fishing season.

The cyclone season

The northern Australian cyclone season occurs from November to April, annually. Given that Lion-1 will be the first well drilled into the Bamaga Basin Gulf Energy again believes it would be prudent not to drill during that period for safety reasons, as well as to avoid consequential operational impediments which could compromise obtaining reliable geological and other important technical information from the well.

Taking the prawn fishing and cyclone seasons into account, the optimal period for drilling Lion-1 is outside those periods, from mid-June to end August. This two-and-a-half-month period allows sufficient time for drilling Lion-1 which is expected to take about 35 days.

Wellsite Survey Environmental Plan Lodged for Approval

Gulf Energy Pty Limited (Gulf Energy) is seeking from the National Offshore Petroleum Safety and Environmental Management Authority (NOPSEMA) the approval for a wellsite survey Environmental Plan.

Gulf Energy Pty Limited (Gulf Energy) is seeking from the National Offshore Petroleum Safety and Environmental Management Authority (NOPSEMA) the approval for a wellsite survey Environmental Plan.

Prior to undertaking exploration drilling activities to assess the viability of the Bamaga Basin as a source of natural gas, Gulf Energy is proposing to undertake a geophysical and geotechnical site survey within a 5 km x 5 km operational area in the Q23/P exploration permit, approximately 110 nm westnorthwest of Weipa (refer to map below). The purpose of this site survey is to ascertain the characteristics of the seabed within the area for future exploration drilling activities.

The site survey, which comprises a geophysical survey and a geotechnical sampling survey, is currently planned to take about four-weeks. It’s start date is subject to receiving all necessary government approvals including NOPSEMA’s environmental approvals, as well as vessel availability and safe operating conditions.

New Analyses Indicate Bamaga Basin has Generated Natural Gas and Petroleum Liquids

Geochemical analysis of rocks from beneath the Gulf of Carpentaria has markedly reduced the exploration risk of Gulf Energy Pty Limited’s Q/23P project by confirming sediments in the Bamaga Basin have generated gas and gas liquids.

Fluid Inclusion Stratigraphic Analysis (FISA) was recently conducted by Schlumberger Technology Corporation on rock cuttings from the Duyken-1 well, located about 100km southwest of Q/23P in the Bamaga Basin, Gulf of Carpentaria. The analysesfound natural gas and gas liquids present as inclusions trapped in drilling cuttings at 450-600m depth in the well (refer to diagram below).

With this important information, and its knowledge of the geology beneath the Gulf of Carpentaria, GULF can draw the following exciting conclusions:

The hydrocarbons could not have been generated from the sediments drilled by Duyken-1 which are not sufficiently mature. They migrated from a deeper, more mature source and the only possible source is the Bamaga Basin beneath Q/23P.

Based on extensive experience, Schlumberger believe the inclusions, and the nature of their occurrence, indicates the gas and gas liquids migrated to Duyken-1 from another location.

This information markedly increases Q/23P’s prospectively and doubles its probability of exploration success from 1 in 9 to 1 in 4.

What is FISA?

Fluid Inclusion Stratigraphy Analysis (FISA) rapidly evaluates the entire borehole for the abundance, distribution, and composition of hydrocarbon and nonhydrocarbon types trapped in inclusions in drilling cuttings or core samples. Interpretation of results is based upon more than 25 years of experience and evaluation of several million samples—from virtually every depositional environment on every continent.

Results provide a depth-based view of the cumulative interaction of the five main elements of a petroleum system: source rock, migration, reservoir, trap, and seal. Evaluation of these fluids—which become isolated and confined within tiny cavities in mineral grains because of cementing and fracture ‘healing’ events—provides the mechanism for determining the present and past distribution of petroleum.

FISA benefits include:

Identifying migration and paleo accumulations in the absence of conventional shows

Evaluating causal relationships among rocks and fluids

Producing a regional picture of petroleum history

Anticipating the eventual perspectivity and distribution of emerging petroleum plays

The FISA technique involves mechanically crushing small core chips or small cuttings samples (0.5 grams of rock or less), followed by bulk analysis of evolved organic and inorganic fluid inclusion volatiles by quadrupole mass spectrometry using a rapid, automated sampling system, which allows continuous stratigraphic mapping of paleo fluids in the subsurface.

The study of over 20,000 wells worldwide has established the application of this technique in addressing petroleum charge and migration elements of risk associated with petroleum exploration and production.

Key indicator compounds and compound ratios are used to document petroleum migration through specific stratigraphic intervals, evaluate petroleum type and quality, and establish a time-integrated effectiveness for potential seals.

Additionally, FISA has proven proficient in identifying zones that are near reservoired petroleum, “proximity to pay”, even if that petroleum did not migrate directly through the analysed section. In these cases, water-soluble hydrocarbons, particularly benzene, toluene and/or organic acids occur in anomalous concentration and can often be shown to have migrated by diffusion through an aqueous phase away from known petroleum accumulations.

Basic Applications:

The technique has been applied in many different scenarios depending on the specific exploration, development or production problem being tackled. Some of the more common applications are:

Evaluate whether petroleum has moved through a dry hole with no shows that is adjacent to a prospect.

Determine whether oil or gas should be anticipated in an area

Infer the presence of a nearby oil field from a well with no hydrocarbon shows.

Investigate oil and gas occurrences from FISA data in relationship to source rocks in the study area.

New Study Re-Rates Bamaga Basin Petroleum Prospectivity

It all begins with an idea.

A recently concluded detailed study by leading Australian consulting firm Molyneaux Advisers has revealed the Bamaga Basin is even more prospective than first thought.

The study concluded:

The Bamaga Basin (Q23/P) has structural characteristics consistent with formation in the Carboniferous to Early Triassic period.

Formation in that time period is consistent with offset basins such as the Laura, Galilee, Bowen and further afield the Perth and Bedout basins.

All those basins:

formed in extensional and strike-slip structural environments before and contemporaneous with the break-up of Gondwana.

contain prolific, or hydrocarbon prone, source rocks, stacked reservoirs and proven sealing intervals. The Bowen, Perth and Bedout basins have significant oil and gas discoveries.

Because of the above, and the presence of petroleum surface slicks in the area, the Bamaga is expected to be a hydrocarbon-prone basin with the possibility of a material gas or oil discovery.

Molyneaux Advisers’ analytical process:

Used macro-scale tectonics to understand what the stress history of the Bamaga is likely to have been.

Used knowledge of the stress history to hypothesise likely structural movement.

Looked for evidence of the structural movement.

Used any evidence to constrain timing of phases of basin formation.

With knowledge of timing, identified with confidence likely paleo-environment and hypothesise reservoir/seal/source juxtaposition.

Earlier work isolated the geological interval of interest. The latest study built on the previous work, and integrated macro-tectonics of the Australian continental plate, together with regional tectonics and stress history to better understand the history of the Bamaga Basin and constrain the age of its sediment deposition and fault movement. From this a tectonic model was developed for the Bamaga area.

The study identified the Bedout, Perth and Bowen basins as having the following similarities to the Bamaga Basin:

They formed at a similar time.

At the time of deposition, they were spatially constrained.

Their paleoclimate was similar – temperate environment getting warmer.

They likely had a fluvio-marine depositional setting.

Similar tectonics – specifically, NW-SE directed extension associated with break-up of Gondwana, after initial rifting (with varying intensity and direction, depending upon the area).

The Bedout, Perth and Bowen basins have all had sizeable oil and gas discoveries, with production coming from the latter two. Development of the Dorado oil field in the Bedout Basin is underway.

Considering the Bamaga, in the context of the regional tectonics, palaeogeography and paleoclimate, observations have been made at a play level for the presence/absence of play elements. As a result, it is believed that on the balance of probabilities, all the elements of a successful hydrocarbon play are present in the Bamaga Basin.

Gulf Energy’s Q/23P Project is to be Showcased at the 2021 AEGC Conference in Brisbane

It all begins with an idea.

The Bamaga Basin, found by Gulf Energy in 2012, is Australia’s newest offshore basin. The intriguing story of how the basin was found and its undiscovered petroleum potential will be presented by Gulf Energy’s Managing Director, Wolfgang Fischer, at the 3rd Australasian Exploration Geoscience Conference (AEGC 2021, 17-20 September) in Brisbane. The presentation is entitled “Hidden in Plain Sight: The Bamaga Basin”.

The presentation will describe the work done so far by Gulf Energy in evaluating the undiscovered oil and gas potential of its Q/23P block overlying the Bamaga Basin, in the Gulf of Carpentaria, offshore Queensland. The Bamaga Basin was unknown until Gulf Energy discovered it with its regional seismic survey conducted in 2012.

In 1984 Duyken-1, the only well drilled in the Gulf of Carpentaria, tested the younger sediments of the overlying Carpentaria and Karumba Basins but not the deeper Bamaga Basin120 km to the southwest, which at the time was unrecognised.

Through the acquisition of modern seismic data, and very careful and precise processing of that data, the sediments and structural configuration of the Bamaga Basin rocks was at last revealed. Independent experts have concluded that the basin has the potential to generate and trap large volumes of natural gas as well as petroleum liquids.

Gulf Energy plans to drill the first exploration well (3195-1) on Prospect 3195, a huge four-way dip closure covering 200 square kilometres in area, with the potential to hold several trillion cubic feet of natural gas or hundreds of millions of barrels of oil. There is plenty of follow-up to a discovery with at least nine targets identified, so far.

The water depth (60 m) and closeness to shore (150 km) make Q/23P operationally and commercially attractive.

Gulf Energy to Make a Presentation on the Q/23P Project in the Bamaga Basin at the APPEA 2021 Conference in Perth

Gulf Energy to Make a Presentation on the Q/23P Project in the Bamaga Basin at the APPEA 2021 Conference in Perth

Gulf Energy’s Managing Director, Wolfgang Fischer, will be making a presentation at this year’s annual Australian Petroleum Production and Exploration Association Conference (APPEA 2021, 14-17 June) in Perth entitled “The Bamaga Basin: A Frontier Play in a Non-Frontier Location”.

The presentation will showcase the work done so far by Gulf Energy in evaluating the undiscovered oil and gas potential of the Q/23P block overlying the Bamaga Basin, in the Gulf of Carpentaria, offshore Queensland. The Bamaga Basin was unknown until Gulf Energy discovered it with its regional seismic survey conducted in 2012.

The Pre-Jurassic Bamaga Basin is overlain by two, previously explored younger sedimentary basins – the Carpentaria and Karumba Basins. In 1984 Duyken-1, the only well in the Gulf of Carpentaria, 120 km southwest of the Bamaga Basin, tested the Carpentaria and Karumba sediments but not the deeper Bamaga Basin, which at the time was unrecognised.

2D regional seismic data acquired in 2012, and a second infill seismic survey in 2014, confirmed the presence of a sedimentary sequence in the Bamaga, and identified an intriguing, complex structural history and large potential petroleum traps. There are nine targets with the potential to hold Prospective Resources of 1 Tcf or more gas each, the largest of which could hold as much as 2.5 Tcf gas.

The water depth (60 m) and closeness to shore (150 km) make it operationally and commercially attractive.

Gulf Energy plans to drill the first exploration well (3195-1) on Prospect 3195, a huge four-way dip closure covering 200 square kilometres in area, with the potential to several trillion cubic feet of natural gas or hundreds of millions of barrels of oil.

NOPTA Grants Gulf Energy’s Q/23P Project an Extension

NOPTA Grants Gulf Energy’s Q/23P Project an Extension

The National Offshore Petroleum Titles Administrator (NOPTA) has advised Gulf Energy that it has been granted a two-year suspension and extension to offshore petroleum exploration permit Q/23P. This means that Gulf Energy has until 17 August 2022 to drill the first exploration well in the Bamaga Basin. It also means the end of the current, second permit term for Q/23P has been moved by two years to 17 August 2024.

The opportunity to apply for a suspension and extension to drill the first well in Q/23P was the result of the meeting of Federal and State Resources Ministers 16 April 2020, at which the offshore petroleum Joint Authorities recognised that the COVID-19 pandemic was having a significant negative impact on the petroleum sector and additional flexibility would be required to assist titleholders to manage and plan their way through the crisis. By offering flexibility in meeting permit work obligations the Joint Authority sought to ensure continuity of exploration effort rather than a reduction.

Preparations are underway to drill a well (3195-1) on Prospect 3195, a huge four-way dip closure covering 200 square kilometres in area, with the potential to contain several trillion cubic feet of natural gas or hundreds of millions of barrels of oil.

A gas discovery and resultant production from Q/23P would:

Create a new ‘energy hub’ in northern Australia producing natural gas and, if it is commercially feasible, possibly also blue hydrogen combined with carbon capture and storage (CCS).

Be the catalyst for development around the Gulf of Carpentaria. It could, for example, provide energy to:

Eastern Australia, which AEMO forecasts will be facing gas shortages in the not-toodistant future.

an alumina refinery at Weipa, processing bauxite from the large deposits on Cape York.

generate base load electricity for northern Queensland.

LNG to be exported to the growing markets in nearby Asia and Southeast Asia. Shell predicts that world LNG demand will double by 2040.

Create thousands of jobs in northern Australia, directly related to development and production operations at Q/23P, as well as new industries (e.g., bauxite processing, electricity generation) and the businesses that provide support services for such projects and industries.

Directly and indirectly benefit communities in northern Australia.

Add billions of dollars of increased economic activity to Australia’s economy.

Contribute to achieving the objectives of the Commonwealth Government’s Gas-Fired Recovery initiative and its White Paper on developing northern Australia entitled Our North, Our Future.