Global LNG Demand is Increasing

Source: METI, LNG Producer-Consumer Conference, June 2025

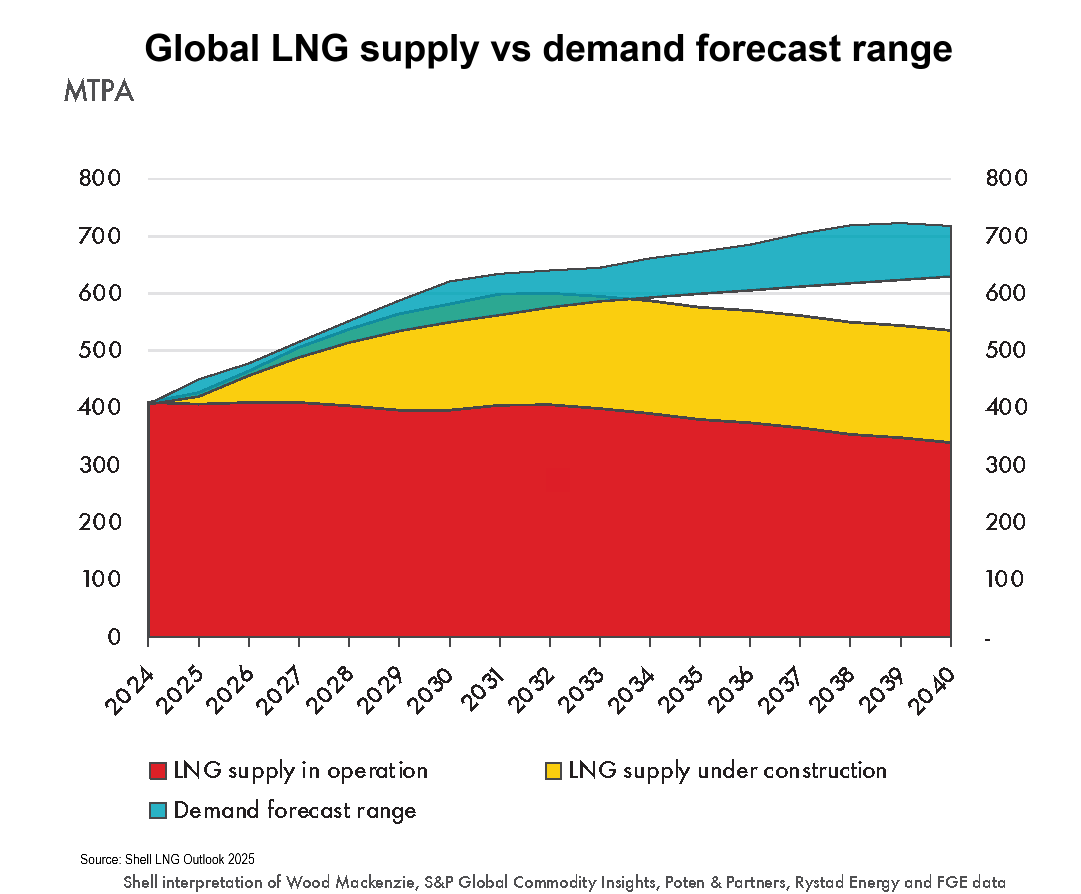

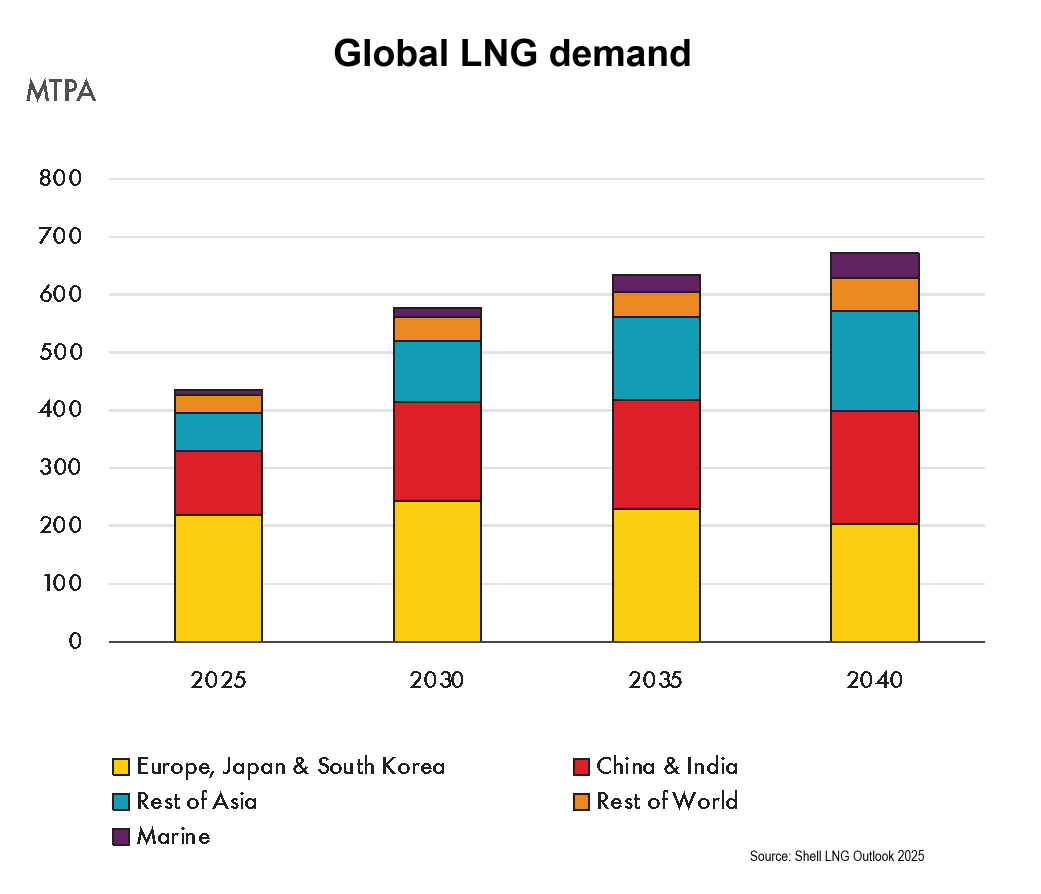

Shell’s LNG Outlook 2025 forecasts demand for liquefied natural gas (LNG) will rise by around 60% by 2040 (refer to chart above, left), largely driven by economic growth in Asia, emissions reductions in heavy industry and transport as well as the impact of artificial intelligence. Industry forecasts now expect LNG demand to reach 630-718 million tonnes a year by 2040, a higher forecast than last year. More than 170 million tonnes of new LNG supply is set to be available by 2030, helping to meet stronger gas demand, especially in Asia, but start-up timings of new LNG projects are uncertain. Shell also expect a continuing global LNG supply shortfall from about 2034.

“Upgraded forecasts show that the world will need more gas for power generation, heating and cooling, industry and transport to meet development and decarbonisation goals,” says Tom Summers, Senior Vice President for Shell LNG Marketing and Trading. “LNG will continue to be a fuel of choice because it’s a reliable, flexible and adaptable way to meet growing global energy demand.”

China is significantly increasing its LNG import capacity and aims to add piped gas connections for 150 million people by 2030 to meet increasing demand. India is also moving ahead with building natural gas infrastructure and adding gas connections to 30 million people over the next five years.

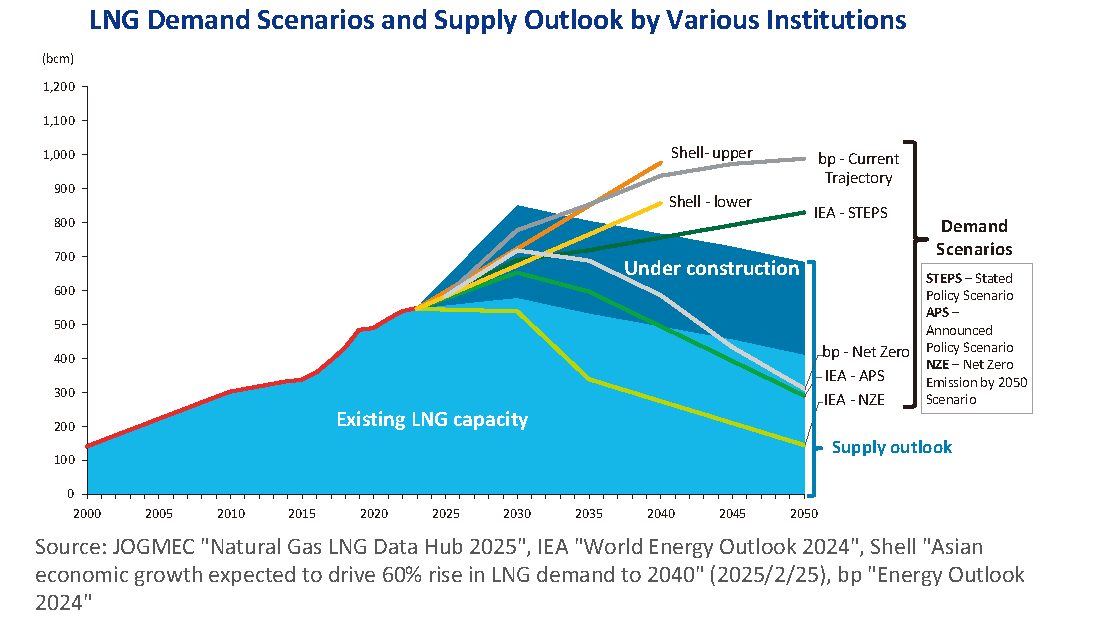

At the 2025 LNG Producer-Consumer Conference the Japanese Ministry of Economy, Trade and Industry (METI) stated LNG supply is expected to broadly align with demand scenarios projected by various institutions through the early 2030s. However, under high-demand scenarios, supply could become tight in the latter half of the 2030s (refer to chart above, right). On the supply side, projections are subject to significant uncertainty in the energy market, with the realization of planned and future LNG projects dependent on investment profitability and access to financing. On the demand side, particularly in emerging economies across Asia, it is important to recognize that demand levels may fluctuate depending on gas price trends, as these economies continue to grow. Under various Net-Zero scenarios an LNG surplus is forecast, but current evidence strongly suggests that the world will fall well short of Net-Zero by 2050, given the huge investments required and the potentially negative economic consequences on the way to getting there.

In the METI’s view, economic growth is expected to drive a continued increase in energy demand, and natural gas, including LNG, is anticipated to play an important role in meeting this growth. Gas-fired power plants contribute to power system stability by balancing the intermittency associated with the expansion of renewable energy. Additionally, as gas-fired generation emits fewer greenhouse gases than coal, fuel switching can support emissions reductions. Moreover, existing gas and LNG infrastructure can be repurposed for emerging low-carbon fuels such as biogas, e-methane, hydrogen, and ammonia, offering further decarbonization potential across the energy value chain. As such, LNG is expected to retain an important role during the energy transition.

Investment in upstream natural gas assets declined between 2015 and around 2020. This was due to a combination of factors, including the oil price decrease, policy and demand uncertainty following the Paris Agreement, increasingly stringent regulations on upstream oil and gas investments, and a strategic shift among energy companies toward renewables. Additionally, energy companies with high leverage suffered from the sharp decline in oil prices. However, since 2021, heightened concerns over energy security, particularly following Russia’s invasion of Ukraine, and the associated spike in commodity prices have reignited upstream investment. Investment in LNG liquefaction projects, which had been constrained during the oil price slump, surged in 2018–2019 in anticipation of the increase of oil price and demand recovery. In 2019, the volume of liquefaction capacity reaching final investment decision (FID) marked a record high. Since 2021, large-scale projects such as Rio Grande Phase 1, Port Arthur Phase 1, and Plaquemines Phase 2 in the United States, and the North Field expansion in Qatar, have also reached FID, pushing liquefaction investment volumes upward.

Remarkably, Australia has not played a major role in this LNG investment surge.

Natural gas is essential for the global energy transition, as evidenced by growing LNG demand

Since the outbreak of the conflict in Ukraine, European and Asian countries more than most have recognized that they must reduce reliance on any one region or country’s supply of energy including natural gas.

Natural gas is both a transition and a destination fuel. Natural gas and LNG are essential for the energy transition as they play an instrumental role in shifting away from coal and moving toward net-zero emissions. As the transition evolves, natural gas will remain vital in providing reliable and efficient energy to support economies in different parts of the world including Australia and all of Asia.

The re-drawing of global energy supply maps is pushing natural gas and LNG demand to new heights and spurring new off-take contracting and other activities and opportunities for companies like Gulf Energy, for example:

Eni SpA has signed an agreement to buy two million metric tons per annum (MMtpa) of liquefied natural gas (LNG) for 20 years from Venture Global Inc.’s under-construction CP2 LNG in Cameron Parish, Louisiana. The Italian state-backed energy major expects deliveries, from phase 1 of the project, to begin by 2030. CP2 LNG is expected to start up 2027. (Rigzone, 17 July 2025)

Equinor Energy AS has agreed to supply natural gas to BASF. The companies signed a 10-year agreement for the supply of about 2 billion cu m/year, representing what the companies call a “substantial share” of BASF’s natural gas needs in Europe. Deliveries will begin Oct. 1, 2025. (Oil & Gas Journal, 16 July 2025)

Santos Ltd. signed a mid-term LNG supply contract with QatarEnergy Trading LLC (QET). The contract, calls for the supply of about 500,000 tonnes/year (tpy) of LNG over a 2-year period beginning in 2026. The LNG is to be supplied from Santos’ portfolio on a delivered ex-ship basis. (Oil & Gas Journal, 15 July 2025)

Rystad Energy expects the Middle East region to overtake Asia this year as the world’s second-largest gas producer, behind North America. Gas production in the region has expanded by about 15% since 2020, with producers intent on monetising their gas resources and increasing exports to help satisfy global demand. (Offshore Mag, 15 July 2025)

The Greater Lafourche Port Commission (GLPC) has acquired a 743-acre tract from the state of Louisiana to expand the site of the proposed Argent LNG project. Argent LNG, which signed a 144-acre lease agreement with Port Fourchon last year, has now secured nearly 900 acres to build a two-phase liquefaction complex with a capacity of about 25 million metric tons per annum (MMtpa). (Rigzone, 14 July 2025)

ADNOC Gas PLC will supply Germany’s state-owned SEFE Securing Energy for Europe GmbH 700,000 metric tons a year of liquefied natural gas (LNG) for three years starting 2025. Abu Dhabi National Oil Co.’s gas processing and sales arm will source the LNG from the Das Island liquefaction facility, which has a capacity of six million metric tons per annum (MMtpa). The contract is valued about $400 million. (Rigzone, 11 July 2025)

Four years after terrorist attacks halted a massive liquefied natural gas project in Mozambique, momentum behind $57 billion in facilities that will export the fuel is picking up. TotalEnergies SE and Eni SpA have readied contractors and signed agreements for preliminary work on projects to add capacity. (Rigzone, 11 July 2025)

Venture Global, Inc. and Securing Energy for Europe GmbH (SEFE) have entered into an agreement under which SEFE’s subsidiary, SEFE Energy GmbH, will purchase an additional 0.75 million metric tons per annum (mtpa) of liquefied natural gas (LNG) from CP2 LNG for 20 years. (Rigzone, 11 July 2025)

Australia’s Woodside Energy Group Ltd. has signed a memorandum of understanding (MOU) with Hyundai Engineering and Hyundai Glovis covering LNG project development, engineering services and shipping logistics. (Rigzone, 10 July 2025)

Oil giant Saudi Aramco (2222.SE), opens new tab is in talks with Commonwealth LNG to buy liquefied natural gas from the U.S. company's proposed facility in Cameron, Louisiana, as it seeks to strengthen its position in the market for the superchilled fuel. (Reuters, 10 July 2025)

Argentina’s Vaca Muerta shale basin holds massive natural gas reserves. The country has multiple LNG export projects underway, including a floating facility (2.5 Mtpa) and planned expansions with Shell, Eni, and others, aiming to export up to 28 Mtpa by 2035. (Oil Price, 10 July 2025)

Malaysia’s national oil and gas company, which owns a 25 percent stake in LNG Canada, has sent its first cargo from the Kitimat, British Columbia project to Japan. The shipment embarked Monday through the 174,000-cubic-meter (6.14 million cubic feet) Puteri Sejinjang LNG vessel. (Rigzone, 9 July 2025)

Australia’s oil and gas player Santos has signed a liquefied natural gas (LNG) supply agreement with QatarEnergy’s LNG trading arm, QatarEnergy Trading. The contract entails the delivery of around 0.5 million tonnes per annum (mtpa) of LNG over two years from 2026. The volumes will be supplied from Santos’ portfolio on a delivered ex-ship basis. (Offshore Energy, 4 July 2025)

Venture Global Inc. has secured a contract with Petroliam Nasional Bhd. (Petronas) to supply the Malaysian national oil and gas company one million metric tons per annum (Mtpa) of liquefied natural gas (LNG) from its CP2 LNG project in Louisiana. (Rigzone, 4 July 2025)

ORLEN SA has agreed to deliver an additional 140 million cubic meters (4.94 billion cubic feet) of liquefied natural gas (LNG) from the United States to Ukraine’s Naftogaz Group via Poland. This is the fourth LNG supply contract signed by the state-owned companies this year, bringing Naftogaz’s total contracted gas volumes from ORLEN to 440 million cubic meters. (Rigzone, 3 July 2025)

Thailand’s Gulf Development Company has signed an engineering, procurement, construction, and commissioning (EPCC) contract with the PEC-CAZ Consortium for the next phase of a liquefied natural gas (LNG) terminal on the eastern coast of the Gulf of Thailand. (Offshore Energy, 2 July 2025)

Russia’s sanctioned Arctic LNG 2 project raised production to record levels during the last days of June as the facility appears to have resumed loading cargoes. Natural gas output at the Novatek PJSC-led facility averaged 14 million cubic meters a day on June 28 and June 29. (Rigzone, 1 July 2025)

Shell PLC and its LNG Canada partners announced Monday they had dispatched the first cargo from the Kitimat, British Columbia project, saying the milestone introduces Canada as an exporter of liquefied natural gas (LNG). With a capacity of 14 million metric tons per annum (MMtpa) from two trains, the facility targets the Asian market. (Rigzone, 1 July 2025)

Global gas markets are experiencing heightened volatility as prices spike in response to escalating tensions between Iran and Israel, even though underlying supply and demand fundamentals remain largely unchanged. The latest flare-up, triggered by Israel’s strikes on Iranian sites on 13 June and subsequent retaliatory actions, has reignited concerns over the security of critical shipping lanes, particularly the Strait of Hormuz. (Petroleum Australia, 1 July 2025)

See past activities and opportunities for companies like Gulf Energy below:

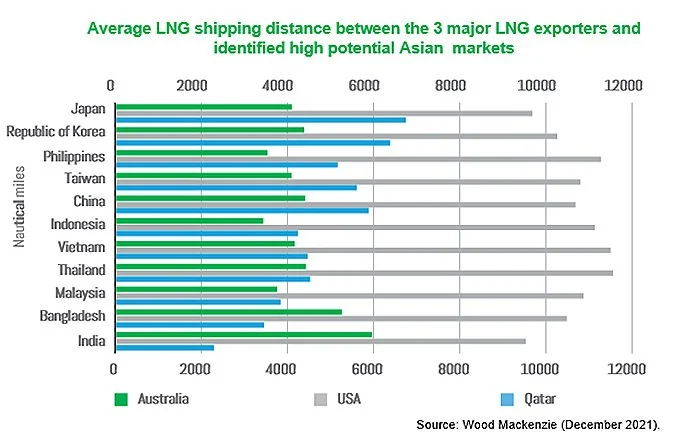

Future global LNG demand will come mainly from Asia, and the Bamaga Basin (Q/23P) is ideally located to supply that market

Australia is ‘Location Competitive’ for much of Asia

Asia’s demand for LNG is forecast to surge, but Australia hasn’t found and developed enough new gas to remain a major global LNG supplier

Australia is closer to most high potential Asian markets than its biggest LNG exporting competitors, Qatar and the USA.

Australia has failed to maintain a steady stream of new gas production projects being brought online.

More than $200 billion of LNG projects were approved for final investment decisions (FIDs) in Australia before 2012. Since then, the Woodside Scarborough Project (Pluto Train 2 Expansion) and the Santos Barossa Project are the only LNG projects to reach FID, with the latter being primarily a backfill project to extend the life of the Darwin LNG facility.

Without further investment in new LNG trains and upstream infrastructure, Australia will lose its position as a major LNG exporter and will almost certainly lose its energy security.