Global LNG demand is increasing

McKinsey has researched the global outlook for gas to 2050 and has determined that gas is the only fossil fuel expected to grow beyond 2030, peaking and plateauing from 2037. From 2035 to 2050, gas demand is forecast to decline by only 0.4 percent. This relatively moderate decline is due to hard-to-replace gas use in the chemical and industrial sectors, which limits the impact of an accelerating decline in gas used for power.

What is concerning to future global demand is the additional supply required to be discovered and/or reach FID (Final Investment Decision) from 2027 onward. It’s not just McKinsey saying the world has a massive future LNG deficiency problem, but also others including BP, Shell and Wood McKenzie. In BP’s Energy Outlook 2023, chief economist Spencer Dale, said investment in upstream production would be needed until 2050 to ensure supply matched demand. “Natural declines in existing production sources mean there needs to be continuing upstream investment in oil and natural gas over the next 30 years,” he wrote in the report.

Natural gas and LNG are essential for the global energy transition, as evidenced by growing long-term supply contracts

Since the outbreak of the conflict in Ukraine, European and Asian countries more than most have recognized that they must reduce reliance on any one region or country’s supply of energy including natural gas.

Natural gas is both a transition and a destination fuel. Natural gas and LNG are essential for the energy transition as they play an instrumental role in shifting away from coal and moving toward net-zero emissions. As the transition evolves, natural gas will remain vital in providing reliable and efficient energy to support economies in different parts of the world including Australia and all of Asia.

The re-drawing of global energy supply maps is pushing natural gas and LNG demand to new heights and spurring new off-take contracting and other activities and opportunities for companies like Gulf Energy, for example:

Oman LNG has signed a 10-year liquefied natural gas supply agreement with Shell, as the state-owned Omani company optimises its operations to meet global consumer demand. The deal involves up to 1.6 million metric tonnes of LNG a year and will start from next year. (The National News, 17 April 2024)

The Energy Market Authority (EMA) and JERA Co., Inc. (JERA) have signed a Memorandum of Understanding (MoU) to cooperate on mutually beneficial areas in liquefied natural gas (LNG) procurement and supply chains for Singapore and Japan. Under the MoU, EMA and JERA will share best practices and knowledge in LNG procurement and management of LNG supplies as well as explore collaboration opportunities in LNG procurement and supply chain management. (Energy Market Authority, 16 April 2024)

The United States exported 10% more natural gas in 2023 than in 2022, a record of 20.9 billion cubic feet per day (Bcf/d), according to our Natural Gas Monthly. U.S. liquefied natural gas (LNG) exports accounted for more than half of all U.S. natural gas exports, and natural gas exports by pipeline to Canada and Mexico accounted for the remainder. (U.S. Energy Information Administration, 15 April 2024)

Philippine electricity supplier First Gen Corp. (FGEN) said Monday it has awarded a contract to CNOOC Gas and Power Trading & Marketing Ltd. for the supply of about 130,000 cubic meters (4.6 million cubic feet) of liquefied natural gas (LNG) for the Southeast Asian country. (Rigzone, 15 April 2024)

MidOcean Energy, the liquefied natural gas (LNG) arm of energy investor EIG, has announced Japan’s Mitsubishi Corp. as an anchor investor, after MicOcean said it plans to supply the East Asian country through newly acquired assets in key LNG exporter Australia. (Rigzone, 4 April 2024)

EIG, the private equity group that partnered with Brookfield for a failed $20 billion takeover of Origin Energy, has secured a foothold in Australia’s gas sector, taking a minority stake in three large projects across Queensland and Western Australia. The Washington-based group said it would open an office in Perth to oversee its investments in Woodside Energy’s Pluto LNG, Chevron’s Gorgon venture and Shell’s Queensland Curtis project. (Australian Financial Review, 3 April 2024)

QatarEnergy and five shipping companies have signed time-charter agreements for 44 newbuild liquefied natural gas (LNG) carriers, raising the number of vessels under QatarEnergy's LNG fleet expansion program to over a hundred, the state-owned gas major said. Twenty-five of the 44 ships announced last week will be owned and operated by Qatar Gas Transport Co. Ltd. (Nakilat) after the two Qatari companies consummated an agreement first announced February 10, according to a news release by QatarEnergy. (Rigzone, 2 April 2024)

MidOcean Energy, a liquefied natural gas (LNG) company formed and managed by institutional investor EIG, has completed its acquisition of Tokyo Gas Co., Ltd’s interests in a portfolio of Australian integrated LNG projects. The acquisition includes Tokyo Gas’ interests in the Gorgon LNG, Pluto LNG and Queensland Curtis LNG projects. (Rigzone, 1 April 2024)

See past activities and opportunities for companies like Gulf Energy below:

Most of the future global LNG demand will come from Asia

Australia is ‘Location Competitive’ for much of Asia

The high potential Asian market for LNG is forecast to double, but Australia hasn’t found or developed enough new gas to meet the predicted demand

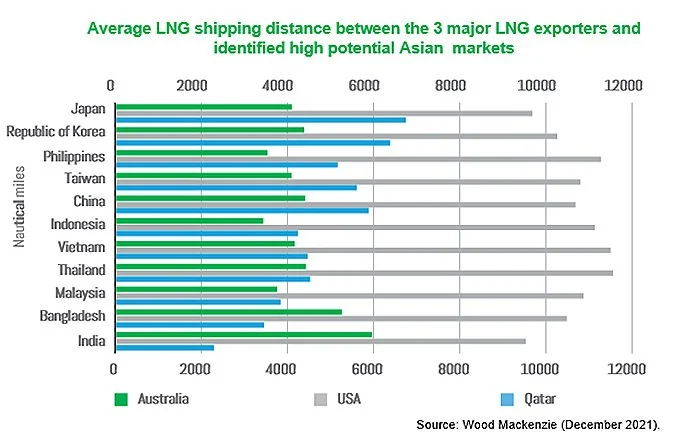

Australia is closer to most high potential Asian markets than its closest LNG exporting competitors, Qatar and the USA.

Australia has failed to maintain a steady stream of new gas production projects being brought online.

More than $200 billion of LNG projects were approved for final investment decisions (FIDs) in Australia before 2012. Since then, Woodside’s Scarborough project is the only LNG capacity project to reach FID (in November 2021).

Without further investment in new LNG trains and upstream infrastructure, Australia may lose its position as a major LNG exporter and will almost certainly lose its energy security.